Simplifying taxes & easing business regulations are key to growth, Aleksishvili

Islamabad : Drawing from international examples, Aleksi Aleksishvili, former Finance Minister of Georgia, shared insights on Georgia’s successful tax reforms, which simplified the tax system and reduced taxes to just six types.

“Simplification of the tax system, along with broader reforms to ease business regulations, is key to fostering growth,” Aleksishvili said.

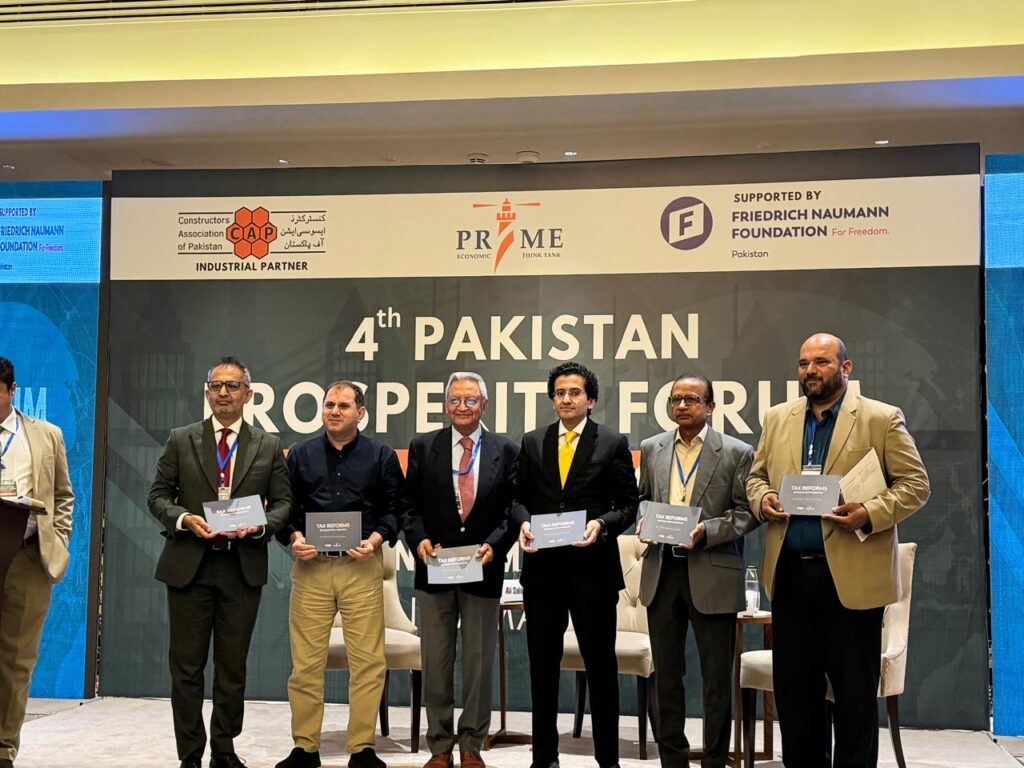

Prime Institute hosted the 4th Pakistan Prosperity Forum , in Islamabad, centered around the theme “Tax Policy for Growth”.

Inclusivity, resilience, and sustainability are the three guiding principles essential for meaningful economic reforms in Pakistan, said Minister of State for Finance, Revenue, and Power, Ali Pervaiz Malik.

Speaking at the forum, Minister of State emphasized that these principles must shape government policy decisions to ensure long-term stability and growth. He also highlighted the government’s push to modernize the Federal Board of Revenue (FBR) through a digitalization program, data sharing and analytics to expand the tax base.

“By leveraging data, we can identify new sources of revenue and improve compliance. This initiative is crucial for improving transparency, enhancing tax collection, and reducing administrative inefficiencies. It will help bring more people into the tax net, making the tax system more equitable,” he added.

“The government is committed to ensuring that reforms are inclusive, resilient, and sustainable,” said Ali Pervaiz Malik. “These principles are vital for creating an economic environment that supports all segments of society and ensures sustained growth over time.”

Meanwhile, KPK Finance Minister Muzammil Aslam pointed out the slow pace of agriculture tax collection. “Out of the Rs. 12,971 billion FBR target for agriculture, only Rs. 5 billion has been collected by provincial governments. Provinces must prioritize tax mobilization, and the federal government should expand its presence in the real estate sector,” Aslam remarked.

Rizwan Rawji, a Supply-Side Economist, warned that State-Owned Enterprises (SOEs) continue to strain fiscal solvency. “State-owned enterprises heavily impact fiscal solvency, and the interest rate should be kept in single digits to reduce the debt burden. We are paying more on external debt than we are receiving in new external financing,” he said.

Arshad Dad, Chief Advisor of the Constructors Association of Pakistan, called for changes to the minimum tax regime, highlighting its impact on Association of Persons facing high withholding taxes. “The current withholding taxes of 7.5%-8% are unsustainable for companies with a 10% profit margin,” he said.

Dr. Ali Salman, Executive Director of PRIME Institute, highlighted the Pakistan’s inconsistent tax policies, stating, “Ad-hoc measures and lack of a coherent policy are damaging Pakistan’s economic prospects. The current tax regime fosters an environment of tax evasion and weak compliance.” He warned of long-term economic instability due to tax evasion, compliance challenges, and revenue shortfalls.

Dr. Mahmood Khalid further suggested eliminating exemptions, which distort the tax system and encourage rent-seeking. He proposed that removing all exemptions, including income tax exemptions, could increase tax revenues by 37% and raise the tax-to-GDP ratio by 3.36%.